When you’re looking into loans—especially for cars, mortgages, or business financing—you might come across the terms balloon payment and deposit. While they both involve lump sums of money, they serve different purposes. Let me break it down in a way that’s easy to understand.

Key Takeaways:

- A balloon payment is a large sum paid at the end of a loan to reduce monthly payments.

- A deposit is an upfront payment to secure a purchase, rental, or lease.

- Balloon payments lower monthly costs but require planning for the final lump sum.

- Deposits show commitment and may be refundable depending on the agreement.

- Understand the terms before agreeing to either to avoid financial surprises.

Quick Comparison Table

| Feature | Balloon Payment | Deposit |

|---|---|---|

| When Paid | End of loan term | At the beginning of a deal |

| Purpose | Reduces monthly payments | Acts as upfront commitment |

| Refundable? | No | Sometimes (depends on terms) |

| Common In | Auto loans, mortgages | Rentals, purchases, leasing |

| Impact on Loan | Leaves a large balance at the end | Reduces the amount to be financed |

What is a Balloon Payment?

A balloon payment is a large lump-sum payment due at the end of a loan. It’s often used to lower monthly payments during the loan period.

For more information, you can check here and here. Also, read our article about Balloon Payment vs Residual here.

Example:

Let’s say you buy a car for $20,000. With a balloon loan:

- You might only repay $15,000 through monthly installments.

- The remaining $5,000 is due at the end as the balloon payment.

Why people choose it:

- Smaller monthly payments

- More flexibility in the short term

But be careful:

You’ll need to pay or refinance the balloon amount when it’s due. If you’re not ready, it can put you in financial trouble.

What is a Deposit?

A deposit is money you pay upfront when starting an agreement—like renting an apartment, buying a house, or leasing a car.

Example:

You want to rent an apartment for $1,000/month. The landlord asks for:

- 1 month’s rent as a deposit = $1,000

This shows you’re serious and gives the owner some security.

Types of deposits:

- Security deposit: Often refundable, protects against damage

- Down payment: Non-refundable, used in purchases (like homes or cars)

Key Differences

1. Timing

- Deposit: Paid at the beginning

- Balloon payment: Paid at the end

2. Function

- Deposit: Acts as a security or commitment

- Balloon: Used to reduce monthly installments

3. Risk

- Balloon payments can be risky if you don’t plan ahead.

- Deposits are more about protecting the seller or lender.

Which One is Better?

It depends on your situation.

- If you need lower monthly payments now and can handle a big payment later, a balloon loan might help—but plan for that lump sum.

- If you’re just starting a contract (like renting or leasing), a deposit is standard and often refundable.

FAQs

What is the main difference between a balloon payment and a deposit?

The core distinction lies in timing and purpose. A balloon payment is a significant lump sum due at the end of a loan term, typically used to reduce monthly repayments throughout the loan period. In contrast, a deposit is an initial payment made at the start of an agreement—such as a lease, purchase, or rental—to demonstrate commitment or secure the arrangement. While balloon payments are common in certain financing models like auto loans and mortgages, deposits are broadly used across industries to minimize lender or seller risk.

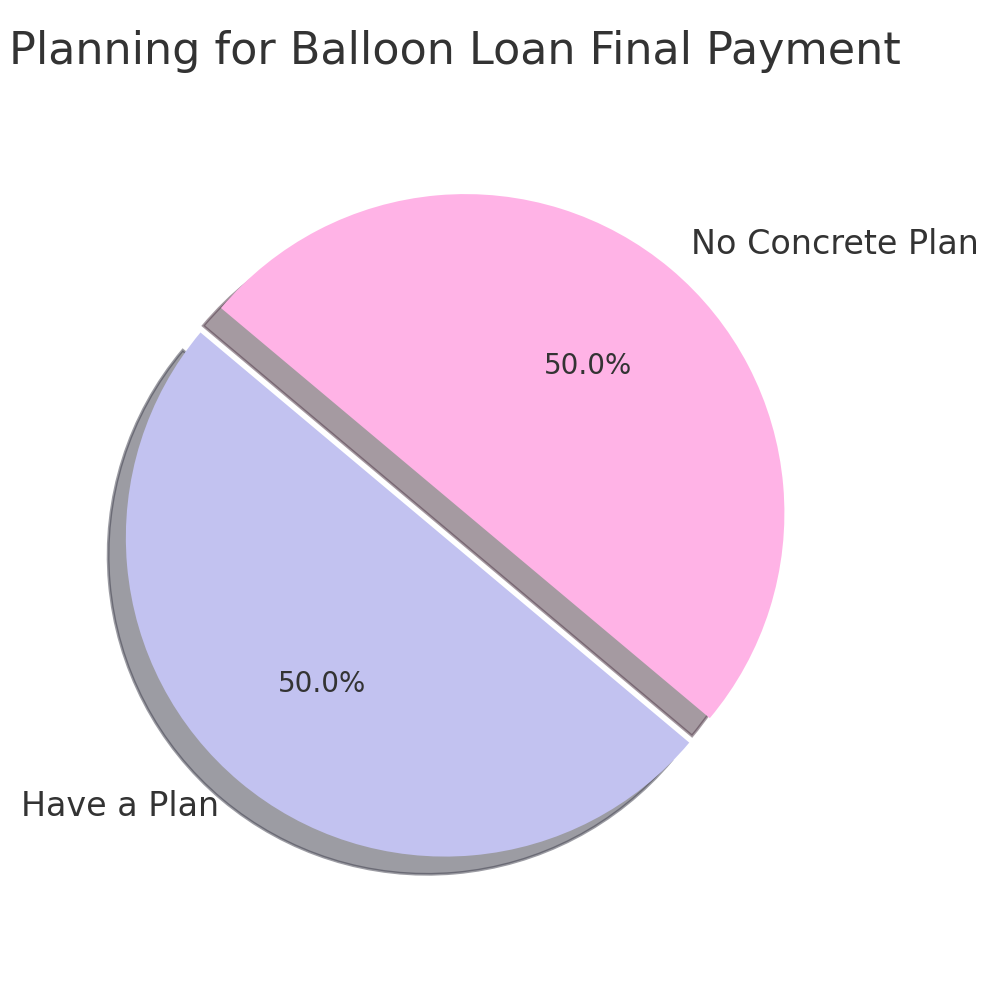

Are balloon payments risky?

Yes, balloon payments can present financial risks if not carefully planned for. While they offer the benefit of lower monthly payments, the borrower is left with a substantial final obligation that must be paid in full, refinanced, or settled through the sale of the asset. If the borrower lacks liquidity or refinancing options when the balloon amount is due, this could lead to default, asset repossession, or unfavorable refinancing terms. Therefore, balloon loans should only be chosen when there is a clear, reliable plan for handling the final payment.

Is a deposit always refundable?

Not all deposits are refundable—it depends on the type of deposit and the terms of the agreement. For instance, security deposits for rental properties are often refundable, provided there’s no damage or breach of contract. On the other hand, down payments for homes, cars, or large purchases are typically non-refundable once a contract is signed. Always review the contract terms carefully to understand whether the deposit will be returned, under what conditions, and within what time frame.

Read also:

- How to Get Rid of a Balloon Payment

- Balloon Payment vs. Bullet Payment

- What Is a Balloon Payment?

- Balloon Payment Examples

- What Are the Disadvantages of a Balloon Payment?

- Balloon Payment vs No Balloon Payment

- Does Settlement Amount Include Balloon Payment?

- How Does a Balloon Repayment Work?

- What is Another Name for a Balloon Payment?

- How is a Balloon Payment Calculated?

- What Happens If You Can’t Pay the Balloon Payment?

- Who Benefits from a Balloon Payment?

- How Long Does It Take to Pay a Balloon Payment?

- Do Banks Do Balloon Payments?

- Is It Worth Paying a Balloon Payment?

Why do lenders offer balloon payment loans?

Lenders offer balloon payment loans to attract borrowers who prefer lower monthly installments, often in the short term. This structure can be appealing for individuals with variable income, businesses with cyclical revenue, or anyone anticipating a financial windfall before the balloon payment is due. From the lender’s perspective, it also creates an opportunity to earn interest on a larger principal throughout the loan while shifting some of the financial risk to the borrower at the end.

Which is better: balloon payment or deposit?

The answer depends on your financial goals and situation. A balloon payment may be suitable if you need to keep your monthly costs low and have a clear exit plan or access to funds later. A deposit, on the other hand, is a standard and often necessary part of securing agreements and shows financial reliability upfront. It doesn’t pose future risk like a balloon payment might. Evaluating both options through the lens of your cash flow, risk tolerance, and contract terms will help determine what’s best for you.

Also read: check Balloon Payment vs no balloon Payment

Final Thoughts

Both balloon payments and deposits are important in financial agreements, but they serve different roles. One is about closing the deal (deposit), and the other is about finishing it (balloon payment).

Always read the fine print.

Know when you’re expected to pay and whether that money is refundable. That’s the key to smart financial decision.